TIBCO Scribe® Online Connector For QuickBooks Online

Use the TIBCO Scribe® Online Connector For QuickBooks Online to accessQuickBooks Online Online data, including customers, invoices and payments. Use it to automate order processing and synchronize customer data with your sales, service, e-commerce, and support systems.

Connector Specifications

| Supported | |

|---|---|

| Agent Types | |

| Connect on-premise | X |

| Connect cloud | X |

| Data Replication Apps | |

| Source | |

| Target | |

| On Schedule Apps | |

| Source | X |

| Target | X |

| On Event Apps | |

| Source | X |

| Target | X |

| Flow | |

| Integration | X |

| Request-Reply | X |

| Message | |

Supported Entities

The QuickBooks Online Connector supports the following entities. Click a linked entity name for additional information when using that entity in TIBCO Cloud™ Integration - Connect. For a list of additional operations by entity see Special Operations.

Standard Operations

| Entity | Query | Create | Update | Delete | Upsert |

|---|---|---|---|---|---|

|

Account |

X |

|

|

|

|

|

Bill |

X |

X |

|

||

|

BillPayment |

X |

X |

|

||

|

X |

|

|

|

|

|

|

X |

|

|

|

|

|

|

Customer |

X |

|

|

|

|

|

Employee |

X |

|

|

|

|

|

X |

|

|

X |

|

|

|

X |

|

|

X |

|

|

|

X |

|

|

|

|

|

|

JournalEntry |

X |

|

|

X |

|

|

Line |

X |

|

|

|

|

|

X |

|

|

|

|

|

|

X |

|

|

X |

|

|

|

Purchase |

X |

|

|

X |

|

|

TaxAgency |

X |

|

|

|

|

|

X |

|

|

|

|

|

|

TaxCode |

X |

|

|

|

|

|

TaxRate |

X |

|

|

|

|

|

Vendor |

X |

|

|

|

|

Special Operations

- CreateWith — Container Block used with Hierarchical Data to add a parent record that may contain one or more child records. This Block collects all of the data for a single record before writing the entire record to the target. See CreateWith Block.

- UpdateWith — Container Block used with Hierarchical Data. Use this Block to update a parent record that may contain one or more child records. This Block collects all of the data for a single parent record before writing the record to the target. See UpdateWith Block.

Note: Operation results from an UpdateWith block are not available for use in subsequent blocks.

- Add — Used for Hierarchical Data to add child records to the parent selected in a CreateWith or UpdateWith Block. See Add Block.

| Entity | Operations |

|---|---|

|

Account |

-CreateWith -UpdateWith |

|

Bill |

-CreateWith -UpdateWith |

|

BillPayment |

-Add -CreateWith -UpdateWith |

|

-Add -CreateWith -UpdateWith |

|

|

Customer |

-Add -CreateWith -UpdateWith |

|

Employee |

-Add -CreateWith -UpdateWith |

|

-Add -CreateWith -UpdateWith -Send |

|

|

-Add -CreateWith -UpdateWith -Send -Void |

|

|

-Add -CreateWith -UpdateWith |

|

|

JournalEntry |

-Add -CreateWith -UpdateWith |

|

-Add -CreateWith -UpdateWith -Void |

|

|

Purchase |

-Add -CreateWith -UpdateWith |

|

Vendor |

-CreateWith -UpdateWith |

Setup Considerations

If you have multiple QuickBooks Online Connections to a QuickBooks Online Company, note the following:

- All Connections must use the same QuickBooks Online Admin User. If the credentials for this user account are modified, you must re-authenticate all of your QuickBooks Online Connections in TIBCO Cloud™ Integration - Connect using the new QuickBooks Online Admin User credentials.

- If you disconnect QuickBooks Online Connector from the QuickBooks Online App in QuickBooks Online using the Apps > My Apps page, you must re-authenticate all of your QuickBooks Online Connections in TIBCO Cloud™ Integration - Connect and give permission for the Connector to access the App.

- When configuring the QuickBooks Online Connection, enter the Company ID with no spaces in it.

API Usage Limits

The Production QuickBooks Online API limits API calls as follows, but may be changed by Inutit without notice:

- 500 requests per minute, per Realm ID.

- 10 concurrent requests per Realm ID and app.

Selecting An Agent Type For QuickBooks Online

Refer to TIBCO Cloud™ Integration - Connect Agents for information on available agent types and how to select the best agent for your app.

Connecting To QuickBooks Online

- Select Connections from the menu.

- From the Connections page select Create

to open the Create a connection dialog.

to open the Create a connection dialog. - Select the Connector from

the list to open the Connection dialog, and then enter the following information for this Connection:

- Name — This can be any meaningful name, up to 25 characters.

- Alias — An alias for this Connection name. The alias is generated from the Connection name, and can be up to 25 characters. The Connection alias can include letters, numbers, and underscores. Spaces and special characters are not accepted. You can change the alias. For more information, see Connection Alias.

- Company ID/Realm ID — A unique number used to identify the company you want to access within QuickBooks Online. In QuickBooks Online navigate to Settings > Your Account > Billing & Subscription to locate your ID. Enter the ID without spaces.

- Is Sandbox Environment — Enable this check box if you are connecting to a company in a developer Sandbox account.

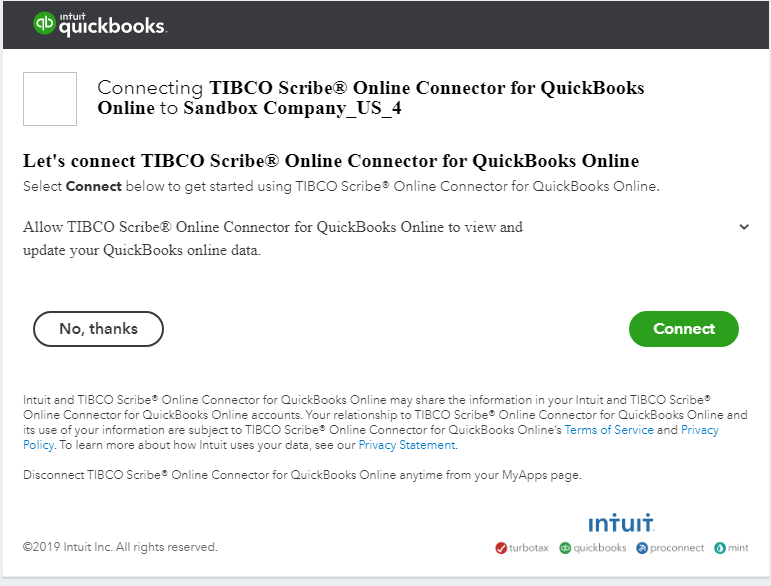

- Select Authenticate to open the QuickBooks Online authorization page:

- If you are not already logged into QuickBooks Online, the QuickBooks Online login page displays. Enter your email address and password, and select Sign in.

- If this is the first time you are creating a QuickBooks Online Connection, the QuickBooks Online Authorization page displays. Select Connect to allow QuickBooks Online to use the data specified.

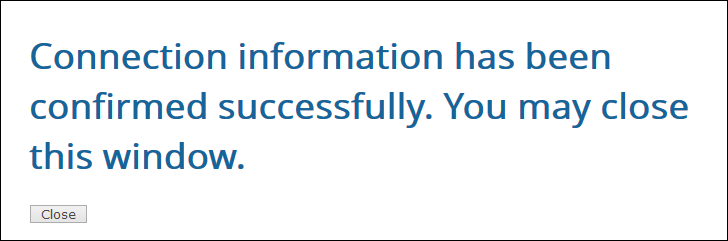

A page with the following message displays:

- Select Test to ensure that the agent can connect to your database. Be sure to test the Connection against all agents that use this Connection. See Testing Connections.

- Select OK/Save to save the Connection.

Metadata Notes

Consider the following for QuickBooks Online data fields and entity types.

- Only US Currency is supported.

- For country specific metadata, only metadata related to the United States is returned.

Naming

Connection metadata must have unique entity, relationship, and field names. If your Connection metadata has duplicate names, review the source system to determine if the duplicates can be renamed.

Relationships

- Hierarchical relationships, such as grandparent, parent, grandchild relationships are supported. See Hierarchical Data for examples.

- The Return only records with this relationship option on the Block Properties Include Tab for Query or Fetch Blocks, is not supported.

- For some entities, if you update a parent record that has associated children and grandchildren, you must map the data for the child and grandchild records or they are deleted. Refer the specific entities in the Notes On Standard Entities section for additional information.

Retry Logic

When a timeout occurs, the QuickBooks Online Connector retries three times with the following delays in between:

- Retry 1 delay = 200 milliseconds

- Retry 2 delay = 400 milliseconds

- Retry 3 delay = 600 milliseconds

When a throttle limit exceeded error is received, the QuickBooks Online Connector retries three times with a 60 second delay between each retry.

QuickBooks Online Connector As An App Source

Consider the following when using the QuickBooks Online Connector as an app source.

Lookup Blocks

- Related entities display in the list of fields on the Fields tab of the Lookup Block when accessing QuickBooks Online. If you select all fields by clicking the Select link at the top of the table, errors are generated on the Errors tab similar to the following:

Field DescriptionOnlyLine is not found or not queryable for entity <entity name>.

Remove the checkmark from the related entities to unselect them and resolve these errors.

- Using the SyncToken field when configuring Lookup Criteria in the Lookup Block generates an error similar to the following when the flow runs:

Operation failed. Label: Lookup Invoice, Name: InvoiceLookup, Message: Bad Request: Error in calling Operation Query (Lookup Block)

Filtering

- Only AND is supported for complex filters. OR is not supported.

- Using the Like operator with a string value contained in parentheses, such as LIKE "(1,2,3)", results in a query that uses the QuickBooks Online In operator as follows: IN ('1','2','3').

- The following operators are not supported:

- Is Not Equal To

- Is Not Like

Net Change

When a datetime is configured on the Query block on the Block Properties Net Change Tab to query for new and updated records, that configuration is treated as an additional filter. The Net Change datetime filter is applied as an AND after any other filters specified on the Block Properties Filter Tab. TIBCO Cloud™ Integration - Connect builds a query combining both the Net Change filter and the filters on the Filter tab. See Net Change And Filters for an example.

Some Connectors for TIBCO Cloud™ Integration - Connect only support one filter. For those Connectors you can use either Net Change or one filter on the Filter tab, not both.

When using Net Change to filter for new and updated records, do not use the DueDate or TxnDate fields as the filter date. These dates do not contain a timestamp and could cause new and updated records to be missed during a subsequent query.

QuickBooks Online Connector As An App Target

Consider the following when using the QuickBooks Online Connector as an app target.

Matching Criteria

Fields available as filters for an entity are also available in target operations that require Matching Criteria. However, best practice is to use Id and SyncToken fields for the most efficient performance.

The SyncToken field is ignored unless it is used with the Id field in Matching Criteria with the Id. When both are used, all other Matching Criteria are ignored.

Required Fields

In some cases, required fields on the Block Properties Fields tab may not be marked as required nor is an error generated on the Errors and Warnings tab after validation. These fields may be required only under certain conditions or the API may not indicate that they are required. When a required field is missing, running the flow generates an error similar to the following:

Operation failed. Label: CreateWith Purchase, Name: PurchaseCreateWith, Message: Status Code: BadRequest Reason Phrase: Bad Request Content as String: {"Fault":{"Error":[{"Message":"Required param missing, need to supply the required value for the API","Detail":"Required Parameter Line.DetailType is missing in the request"

Notes On Standard Entities

Account

Fields

Some AccountSubType field values are available in the QuickBooks Online API, but are not supported. The following values generate an Invalid Enumeration error when used in a TIBCO Cloud™ Integration - Connect field mapping:

- AccountType — Expense, AccountSubType — CommsionsAndFees

- AccountType — Expense, AccountSubType —OfficeExpenses

The AccountSubType field value UndistributedTips under AccountType Other Current Liability is available in the QuickBooks Online UI but is not supported in the API.An Invalid Enumeration error is generated when this value is used in a TIBCO Cloud™ Integration - Connect field mapping.

In some cases, the names of AccountTypes and AccountSubTypes are not the same in the QuickBooks Online UI and API. When viewing AccountType and AccountSubType values in the Query Block Preview Tab, the UI names are displayed. However, when mapping a value in the Fields tab of a target operation Block, you must use the name recognized by the API.

|

UI Value |

API Value |

Notes |

||

|---|---|---|---|---|

|

AccountType |

AccountSubType |

AccountType |

AccountSubType |

|

|

Expenses |

Tax Expense |

Expense |

GlobalTaxExpense |

The UI value, Tax Expense, is visible when the API value, GlobalTaxExpense has been added using a TIBCO Cloud™ Integration - Connect field mapping. However, Tax Expense cannot be selected using the QuickBooks Online UI. |

|

Other Expense |

Mortgage Interest Home Office Rent and Lease Home Office |

Other Expense |

MortgageInterest RentAndLease |

|

|

Expense |

Utilities Home Office |

Other Expense |

Utilities |

|

|

Other Current Liability |

Sales Tax Payable SalesTax Suspense Direct Deposit Payable |

Other Current Liability |

GlobalTaxPayable GlobalTaxSuspense DirectDeposit Payable |

The UI values, Sales Tax Suspense and Direct Deposit Payable are visible when GlobalTaxSuspense or DirectDepositPayable have been added using a TIBCO Cloud™ Integration - Connect field mapping. However, those values cannot be selected using the QuickBooks Online UI. |

When entering a value for the AccountSubType field, do not use any spaces or special characters.See the Account Entity Field Values And Dependencies table for a list of valid field values.

Descriptions for some Account entity enum fields displayed on the Block Properties Fields tab do not contain the entire list of possible values because that list is too long. In addition there are dependencies between these fields. For example, if the Classification field value is ASSET, then the AccountType field value is limited to Bank, OtherCurrentAsset, FixedAsset, OtherAsset, or AccountsReceivable. The field value in AccountType in turn limits the value of AccountSubType. Review the Account Entity Field Values And Dependencies table for the complete list of values and dependencies.

Account Entity Field Values And Dependencies

|

Classification Field |

||

|---|---|---|

|

ASSET |

||

|

AccountType Fields |

AccountSubType Fields |

|

|

Bank |

CashAndCashEquivalents CashOnHand Checking MoneyMarket |

OtherEarMarkedBankAccounts RentsHeldInTrust Savings TrustAccounts |

|

Other Current Asset |

AllowanceForBadDebts AssetsAvailableForSale BalWithGovtAuthorities CalledUpShareCapitalNotPaid DevelopmentCosts EmployeeCashAdvances ExpenditureAuthorisationsAndLettersOfCredit GlobalTaxDeferred GlobalTaxRefund InternalTransfers Inventory Investment_MortgageRealEstateLoans Investment_Other Investment_TaxExemptSecurities |

Investment_USGovernmentObligations LoansToOfficers LoansToOthers LoansToStockholders OtherConsumables OtherCurrentAssets PrepaidExpenses ProvisionsCurrentAssets Retainage ShortTermInvestmentsInRelatedParties ShortTermLoansAndAdvancesToRelatedParties TradeAndOtherReceivables UndepositedFunds |

|

FixedAsset |

AccumulatedAmortization AccumulatedDepletion AccumulatedDepreciation AssetsInCourseOfConstruction Buildings CapitalWip CumulativeDepreciationOnIntangibleAssets DepletableAssets FixedAssetComputers FixedAssetCopiers FixedAssetFurniture FixedAssetPhone FixedAssetPhotoVideo FixedAssetSoftware |

FixedAssetOtherToolsEquipment FurnitureAndFixtures (default) IntangibleAssets IntangibleAssetsUnderDevelopment Land LandAsset LeaseholdImprovements MachineryAndEquipment NonCurrentAssets OtherFixedAssets ParticipatingInterests ProvisionsFixedAssets Vehicles |

|

OtherAsset |

AccumulatedAmortizationOfOtherAssets AssetsHeldForSale AvailableForSaleFinancialAssets DeferredTax Goodwill Investments LeaseBuyout Licenses LongTermInvestments |

LongTermLoansAndAdvancesToRelatedParties OrganizationalCosts OtherIntangibleAssets OtherLongTermAssets OtherLongTermInvestments OtherLongTermLoansAndAdvances PrepaymentsAndAccruedIncome ProvisionsNonCurrentAssets SecurityDeposits |

|

Accounts Receivable |

AccountsReceivable |

|

|

EQUITY |

||

|

AccountType Fields |

AccountSubType Fields |

|

|

Equity |

AccumulatedAdjustment AccumulatedOtherComprehensiveIncome CalledUpShareCapital CapitalReserves CommonStock DividendDisbursed EquityInEarningsOfSubsiduaries EstimatedTaxes Funds Healthcare InvestmentGrants MoneyReceivedAgainstShareWarrants OpeningBalanceEquity |

OtherFreeReserves OwnersEquity PaidInCapitalOrSurplus PartnerContributions PartnerDistributions PartnersEquity PreferredStock PersonalExpense PersonalIncome RetainedEarnings ShareApplicationMoneyPendingAllotment ShareCapital TreasuryStock |

|

EXPENSE |

||

|

AccountType Fields |

AccountSubType Fields |

|

|

Expense |

AdvertisingPromotional AmortizationExpense AppropriationsToDepreciation Auto BadDebts BankCharges BorrowingCost CharitableContributions CommissionsAndFees CostOfLabor DistributionCosts DuesSubscriptions Entertainment EntertainmentMeals EquipmentRental ExternalServices ExtraordinaryCharges FinanceCosts GlobalTaxExpense IncomeTaxExpense Insurance InterestPaid LegalProfessionalFees LossOnDiscontinuedOperationsNetOfTax ManagementCompensation OtherCurrentOperatingCharges |

OfficeExpenses OfficeGeneralAdministrativeExpenses OtherBusinessExpenses OtherExternalServices OtherMiscellaneousServiceCost OtherRentalCosts OtherSellingExpenses PayrollExpenses ProjectStudiesSurveysAssessments PromotionalMeals PurchasesRebates RentOrLeaseOfBuildings RepairMaintenance ShippingAndDeliveryExpense ShippingFreightDelivery StaffCosts Sundry SuppliesMaterials TaxesPaid Travel TravelExpensesGeneralAndAdminExpenses TravelExpensesSellingExpense TravelMeals UnappliedCashBillPaymentExpense Utilities |

|

Other Expense |

Amortization DeferredTaxExpense Depletion Depreciation ExceptionalItems ExchangeGainOrLoss ExtraordinaryItems GasAndFuel HomeOffice HomeOwnerRentalInsurance IncomeTaxOtherExpense MatCredit MortgageInterest OtherHomeOfficeExpenses OtherMiscellaneousExpense OtherVehicleExpenses |

ParkingAndTolls PenaltiesSettlements PriorPeriodItems RentAndLease RepairsAndMaintenance TaxRoundoffGainOrLoss Utilities Vehicle VehicleInsurance VehicleLease VehicleLoanInterest VehicleLoan VehicleRegistration VehicleRepairs WashAndRoadServices |

|

Cost of Goods Sold |

CostOfLaborCos CostOfSales EquipmentRentalCos FreightAndDeliveryCost |

OtherCostsOfServiceCos ShippingFreightDeliveryCos SuppliesMaterialsCogs |

|

LIABILITY |

||

|

AccountType Fields |

AccountSubType Fields |

|

|

Accounts Payable |

Accounts Payable OutstandingDuesMicroSmallEnterprise |

OutstandingDuesOtherThanMicroSmallEnterprise |

|

Credit Card |

Credit Card |

|

|

Long Term Liability |

AccrualsAndDeferredIncome AccruedLongLermLiabilities AccruedVacationPayable BankLoans DebtsRelatedToParticipatingInterests DeferredTaxLiabilities GovernmentAndOtherPublicAuthorities GroupAndAssociates LiabilitiesRelatedToAssetsHeldForSale LongTermBorrowings |

LongTermDebit LongTermEmployeeBenefitObligationsNotesPayable ObligationsUnderFinanceLeases OtherLongTermLiabilities OtherLongTermProvisions ProvisionForLiabilities ProvisionsNonCurrentLiabilities ShareholderNotesPayable StaffAndRelatedLongTermLiabilityAccounts |

|

Other Current Liability |

AccruedLiabilities CurrentLiabilities CurrentPortionEmployeeBenefitsObligations CurrentPortionOfObligationsUnderFinanceLeases CurrentTaxLiability DirectDepositPayable DividendsPayable DutiesAndTaxes FederalIncomeTaxPayable InsurancePayable InterestPayables LineOfCredit LoanPayable GlobalTaxPayable GlobalTaxSuspense |

OtherCurrentLiabilities PayrollClearing PayrollTaxPayable PrepaidExpensesPayable ProvisionForWarrantyObligations ProvisionsCurrentLiabilities RentsInTrustLiability SalesTaxPayable ShortTermBorrowings SocialSecurityAgencies StaffAndRelatedLiabilityAccounts StateLocalIncomeTaxPayable SundryDebtorsAndCreditors TradeAndOtherPayables TrustAccountsLiabilities |

|

REVENUE |

||

|

AccountType Fields |

AccountSubType Fields |

|

|

Income |

CashReceiptIncome DiscountsRefundsGiven NonProfitIncome OperatingGrants OtherCurrentOperatingIncome OtherPrimaryIncome OwnWorkCapitalized |

RevenueGeneral SalesOfProductIncome SalesRetail SalesWholesale SavingsByTaxScheme ServiceFeeIncome UnappliedCashPaymentIncome |

|

Other Income |

DividendIncome GainLossOnSaleOfFixedAssets GainLossOnSaleOfInvestments InterestEarned LossOnDisposalOfAssets |

OtherInvestmentIncome OtherMiscellaneousIncome OtherOperatingIncome TaxExemptInterest UnrealisedLossOnSecuritiesNetOfTax |

Bundle

- The Bundle entity is a type of Item. The QuickBooks Online API supports creating Items, but not Bundles. See Item.

Category

- The Category entity is a type of Item. See Item.

Estimate

- Filters - Filtering on the DueDate field is not supported.

- Custom Fields —

- Only StringType fields are supported.

- When creating or updating data in a custom field, you must provide three of the four field elements. For example, for a StringType custom field you must provide the following:

- <fieldname>_DefinitionId — Id of each custom field in the order listed in Sales Settings in the QuickBooks Online user interface. Typically, these values are 1, 2, or 3.

- <fieldname>_StringValue — The mapped input to your custom field.

- <fieldname>_Type — Indicates the field type for the custom field, which should be StringType.

- CreateWith — When creating an Estimate, populate the related GroupLine entity with any Bundle Items you want to include. The associated GroupLine.GroupLineDetail_Line entity child records are created automatically.

- UpdateWith —

- If you update the parent Estimate record without modifying any child or grandchild record, the associated child and grandchild records are retained.

- If you update the parent Estimate record and modify a child or grandchild record, such as the line item types SalesLineItem or GroupLine, you must recreate all of the child and grandchild records that you wish to retain. Anytime a child or grandchild on an Estimate is updated, all of the children and grandchildren are deleted and must be recreated.

- When updating GroupLine child records for an existing Estimate you must populate both the GroupLine entity and associated GroupLine.GroupLineDetail_Line entity child records.

- When updating the DiscountLine child entity, if the discount is percentage based:

- The DiscountLineDetail_Percent field cannot be set to NULL to remove the discount.

- The DiscountLineDetail_PercentBased field cannot be changed to NULL or false to switch to an amount based discount.

- When updating the DiscountLine child entity, if the discount is amount based:

- The DiscountLineDetail_Percent field can be set to NULL to remove the discount.

- The DiscountLineDetail_PercentBased field can be changed true to switch to a percentage based discount.

- Send — Sends the Estimate via email to the email address mapped in the SendTo field. If no address is specified, address in the Estimate.BillEmail.EmailAddress field is used.

- To flag a SalesItemLine as taxable, populate the field SalesItemLineDetail_TaxCodeRef_Value with the word Tax.

- Creating or updating TxnTaxDetail_TaxLine entity child records does not affect the taxes on an Estimate. Use the TaxCode assigned to the Estimate to indicate which Tax Code to use to calculate taxes on the taxable line items.

- Creating or updating SubTotalLine entity child records does not affect the subtotal on an Estimate.

Invoice

- Custom Fields —

- Only StringType fields are supported.

- When creating or updating data in a custom field, you must provide three of the four field elements. For example, for a StringType custom field you must provide the following:

- <fieldname>_DefinitionId — Id of each custom field in the order listed in Sales Settings in the QuickBooks Online user interface. Typically, these values are 1, 2, or 3.

- <fieldname>_StringValue — The mapped input to your custom field.

- <fieldname>_Type — Indicates the field type for the custom field, which should be StringType.

- CreateWith — When creating an Invoice, populate the GroupLine entity with any Bundle Items you want to include. The associated GroupLine.GroupLineDetail_Line entity child records are created automatically.

- UpdateWith —

- If you update the parent Invoice record without modifying any child or grandchild record, the associated child and grandchild records are retained.

- If you update the parent Invoice record and modify a child or grandchild record, such as the line item types SalesLineItem or GroupLine, you must recreate all of the child and grandchild records that you wish to retain. Anytime a child or grandchild on an Invoice is updated, all of the children and grandchildren are deleted and must be recreated.

- When updating GroupLine records for an existing Invoice you must populate both the GroupLine entity and associated GroupLine.GroupLineDetail_Line entity child records.

- When updating the DiscountLine child entity, if the discount is percentage based:

- The DiscountLineDetail_Percent field cannot be set to NULL to remove the discount.

- The DiscountLineDetail_PercentBased field cannot be changed to NULL or false to switch to an amount based discount.

- When updating the DiscountLine child entity, if the discount is amount based:

- The DiscountLineDetail_Percent field can be set to NULL to remove the discount.

- The DiscountLineDetail_PercentBased field can be changed true to switch to a percentage based discount.

- Delete — Before deleting an Invoice, delete all linked transactions. Deleting an Invoice with linked transactions generates orphan transaction records.

- Send — Sends the Invoice via email to the email address mapped in the SendTo field. If no address is specified, address in the Invoice.BillEmail.EmailAddress field is used.

- Void — If you Void an Invoice more than once, Voided appears in the private notes for the Invoice once for each time the Invoice was Voided.

- To flag a SalesItemLine as taxable, populate the field SalesItemLineDetail_TaxCodeRef_Value with the word Tax.

- Creating or updating TxnTaxDetail_TaxLine entity child records does not affect the taxes on an Invoice. Use the TaxCode assigned to the Invoice to indicate which Tax Code to use to calculate taxes on the taxable line items.

- Creating or updating SubTotalLine entity child records does not affect the subtotal on an Invoice.

Item

- The Item entity represents three types of records, Items, Bundles, and Categories. Only some of the fields in the Item entity apply to each type. For example, the UnitPrice and QtyOnHand fields only apply to Item entity type Item. Review the QuickBooks Online API documentation to ensure you have a basic understanding of the fields that go with each Item Type.

- Bundle, Category, and Item can be queried separately.

Line

- Line entities are children of the Invoice, Estimate, and Payment records. Names of these entities vary depending on the line being added, such as SalesItemLine or DiscountLine.

- Use the Add Block inside the CreateWith or UpdateWith Block to add one or more Line child records to an Invoice, Estimate, or Payment parent record.

LinkedTxn

- Add — Use the Add Block inside the CreateWith Block to add one or more LinkedTxn child records to an Invoice, Estimate, or Payment parent record.

- Using the Add Block inside an UpdateWith Block to update LinkedTxn child records for an Invoice, Estimate, or Payment parent record does not modify existing links.

Payment

- The Payment entity contains an undocumented related grandchild entity, any, that contains name value pairs. Refer to the Intuit Developer API documentation to view an example of that entity in the Payment sample object.

- UpdateWith —

- If you update the parent Payment record any unmapped children or grandchildren are removed. When modifying a Payment you must map all of the child and grandchild records that you wish to retain.

TaxClassification

- Filters —

- Using Net Change to filter for new and updated records is not supported for this entity.

- When querying this entity, only one filter field can be used at a time.

- Equals is the only operator supported. If other operators are used, they are ignored and Equals is used.

TaxCode

- Filters — If you configure a filter that should result in one of the system generated tax code records being returned, no records are returned. This also applies to using the Net Change to filter for new and updated records.

TaxRate

- Filters — For QuickBooks Online sandbox accounts, filtering by the Active field is not supported and generates bad request errors. This issue is being tracked by Intuit under defect number PLEX-2416.

TIBCO Cloud™ Integration - Connect API Considerations

License Agreement

The TIBCO End User License Agreement for the QuickBooks Online Connector describes TIBCO and your legal obligations and requirements. TIBCO suggests that you read the End User License Agreement.

More Information

For additional information on this Connector, refer to the Knowledge Base and Discussions in the TIBCO Community.